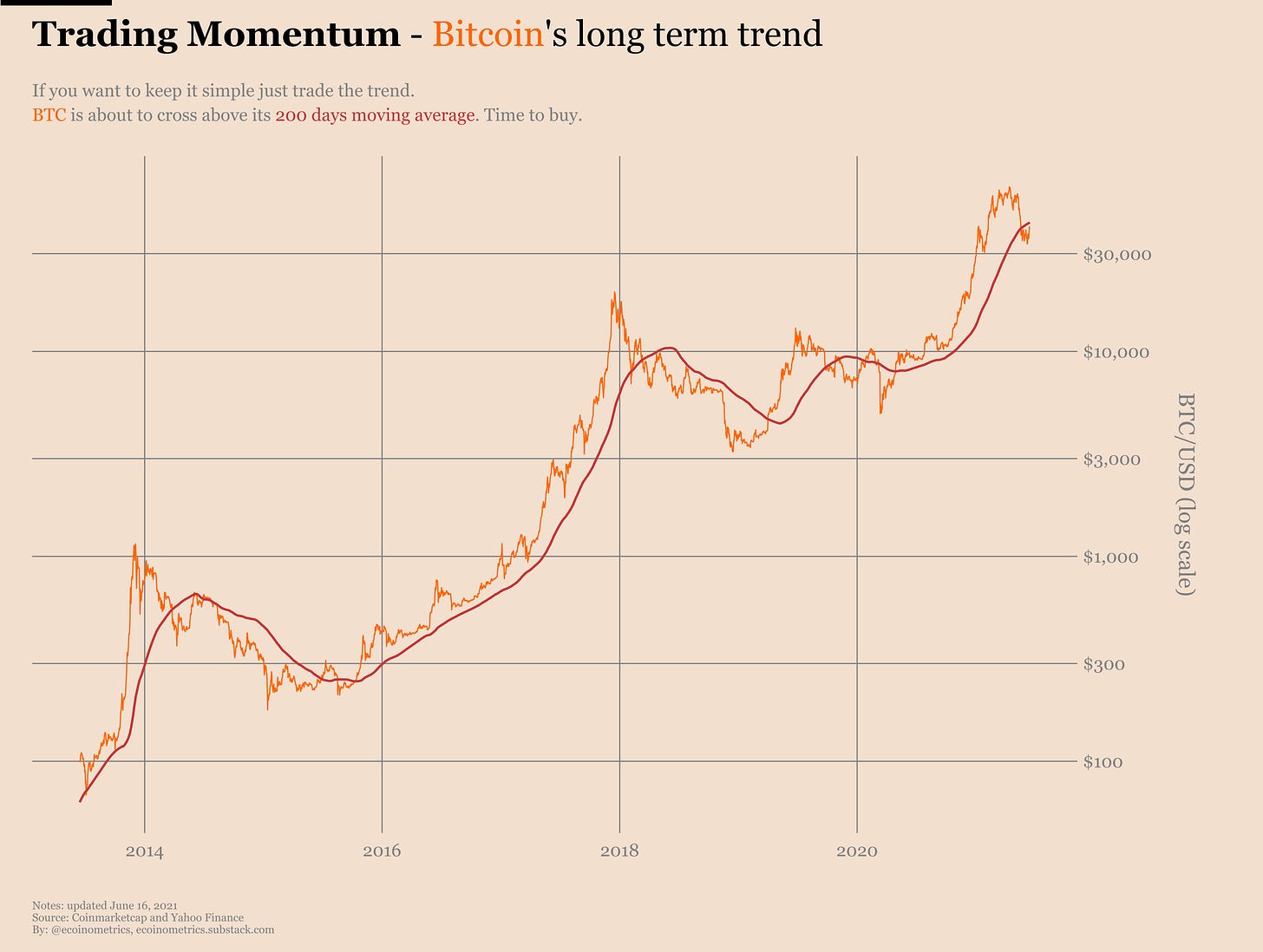

This strategy for Bitcoin has been profitable since 2014

There are various commonalities between ‘almost’ Bitcoin investors. When the bullish cycle is in full force, these investors claim that they will buy in when market correction takes place. When corrections unfold, they remain uncertain whether to enter or not, and thereby, possibly miss entry opportunities.

The current market structure presents the same dilemma. It is unclear at the moment if Bitcoin is going back to its previous ATH levels. The asset has witnessed recoveries over the past couple of weeks, but it hasn’t been convincing enough.

For mid-term investors, there might be a way to cancel market noise and enter based on a proven strategy. (Note: The strategy does not incorporate black swan events.)

By stating mid-term investors in the previous paragraph, it means traders would not have to wait 5-10 years before cashing out. Trading with the trend lasts between 6-months to 2-year, and returns can be extremely high if a major trend is caught.

Data from Ecoinometrics, is indicative of the strategy, where a buy-position should be facilitated when the asset closes a daily candle above the 200-Daily Moving Average. While this is not a new strategy by any means, it could be a vital one to describe the current situation.

If the 1-day chart of Bitcoin is closely observed, it is currently oscillating just under the 200-DMA at press time. The range determined that Bitcoin needs to close above to confirm a bullish flip remains between $41,500-$43,500. Once BTC is above the 200-DMA and closes a daily candle above the moving average, it is a strong trend reversal indicator. Therefore, investors should still be patient in terms of setting up their buying orders.

One particular factor which supports the possible trend flip is the Fear and Greed Index of Bitcoin.

Bitcoin reached a level of extreme fear last week for the first time in a year. However, over the last few days, it has made adjustments and sentiment is currently at the ‘fear’ state. Historically, this sentiment has triggered massive buy opportunities for BTC traders, and it could be one that unveils a trend flip going forward.

Yes. Unlike other factors that may include specific cryptocurrency metrics, the momentum trend strategy has been effective with other assets from the traditional market as well. Notable examples being APPLE and Gold.

As observed, AAPL continues to remain above the 200-DMA, indicative of its continued bullish trend. The same has been observed since the beginning of 2018, as illustrated in the chart. Hence, trading with momentum can be essential with respect to both cryptocurrencies and traditional tech stocks or commodities.

Article comments