Ethereum Paying Nearly 10% of Its Market Cap to Miners, Holders Vote to Reduce it By Two Thirds

Ethereum is paying miners around $2.5 billion a year at current prices while its market cap stands at $32 billion.

Including the block base reward, uncles rewards, and mining fees, ethereum has paid miners around $6.6 million in the past 24 hours, translating to $2.36 billion a year.

That means ethereum’s inflation rate is currently at 7.3%, almost double that of bitcoin, which paid miners $12.7 million in the past 24 hours. Translating to $4.5 billion on a market cap of around $109 billion or just about 4% of the total supply.

This considerable inflation rate in ethereum is up for discussion due to a necessity to delay the difficulty bomb which is programmed to make mining almost impossible so as to incentivize a move to Proof of Stake.

Casper, however, will probably not be ready now until next year. The difficulty bomb, therefore, has to be postponed, but doing so without reducing issuance mean inflation continues at a higher rate than was planned.

Eth did not intend to have a supply much higher than 100 million prior to Casper. Currently it stands at 101.3 million.

A reduction in issuance, therefore, has been suggested to keep inflation at around the level it would have been had the difficulty bomb not been delayed.

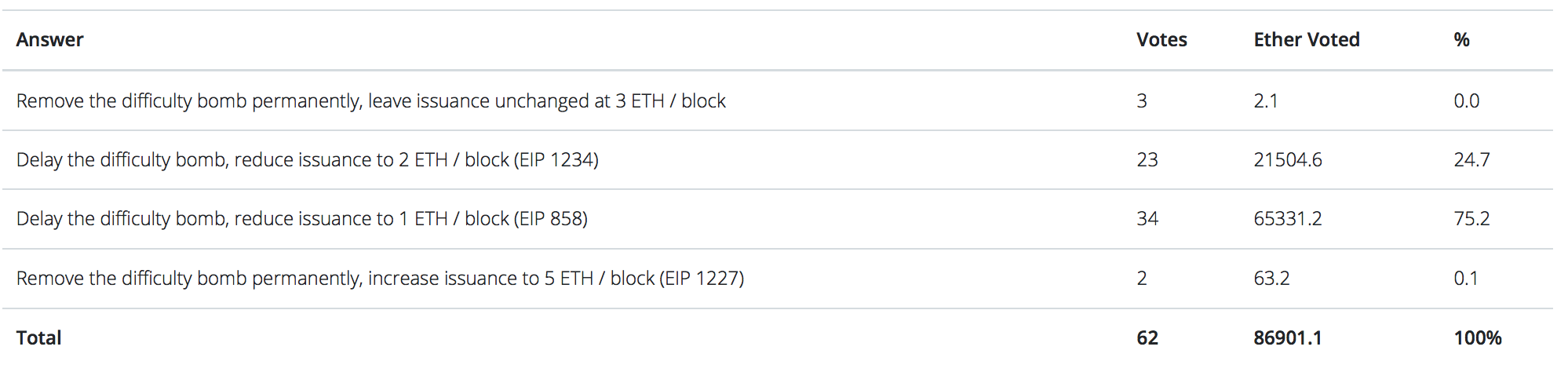

There are four proposals on the table. A trollish proposal that says block rewards should be increased to 5 eth, that being inflation should be doubled to nearly 14%. Another proposal that says it should remain at 3 eth. A proposal that wants to reduce it to 2 eth and another which wants to reduce it to 1 eth.

Some 65,000 eth, worth $21 million at current prices, have voted in favor of reducing issuance to just 1 eth per block. That would give an inflation rate of 2.3%, lower than bitcoin’s until 2020 when they would then be at a similar inflation rate.

While around $7 million worth of eth, at around 21,500, want a reduction to 2 eth per block, giving an inflation rate of around 4%, similar to bitcoin’s for now.

In combination, the votes in favor of reducing issuance far outweigh any other option to the extent that there appears to be a pretty much unanimous agreement as far as this vote is concerned.

The number of addresses that have voted are however small, and some miners do of course complain because they’d be earning less.

Yet that assumption might not necessarily be true where fiat earnings are concerned. That’s because if demand remains constant, a reduction in supply should lead to an increase in price, meaning that in theory miners would be earning the same as now in fiat, but less in eth.

Those considerations, however, might be irrelevant as the main question is whether one eth per block is sufficient to provide for eth’s security.

Measuring that is difficult, but one metric might be the comparison of block rewards to amounts transferred.

Around $365 million eth moved in the past 24 hours, with $580 being the average value of an eth transaction.

By comparison, $4 billion worth of bitcoin moved in the past 24 hours, with $25,000 being the average value of a bitcoin transaction.

That means bitcoin is transferring stupendously more than eth in dollar values, while paying hardly much more than ethereum for its security.

One complication here is the fact that bitcoin has ten minute blocks at an $80,000 reward per block. Eth runs on 15 seconds at $1,150 per block.

That means under current stats, which do vary, a bitcoin miner earns three times more by gaining the block reward rather than orphaning an average transaction, while an eth miner earns only twice.

Obviously there are other considerations here and they are numerous. Practically, one can’t easily imagine a miner colluding with an attacker to double spend a transaction because he might earn more by doing so than picking up the block reward, unless the upside is stupendous and there is a conspiracy of sorts.

That can only be done once, while the block reward is constant. Plus the miner doesn’t necessarily know if he is the one mining the block and so on, he’d need considerable hashpower and on and on.

Yet perhaps it is a reasonable estimation of what security is just about enough with some leeway either way. Which means 1 eth per block might perhaps be a bit risky to go to for now, while 2 eth is probably reasonable.

Issuance would then be reduced again once Casper to 0.82 eth per block, hopefully some time next year, when it would be a lot safer to do so because of staking.

It appears thus for now it is a bit unnecessary to go that far despite the vote, but two eth per block sounds like it would provide sufficient security while also keeping inflation within a reasonable level so as to balance more appropriately the many needs of the network.

Copyrights Trustnodes.com

Article comments